CA OVES ALI KHAN

PANAMA: – A TAX HAVEN

Panama offers the most favourable and most flexible company incorporation laws available in the world. Private Interest Foundations are also available, and are one of the most widely used estate planning structures in the world today. Panama is the registered domicile for over 400,000 corporations &foundations, making it one of the most popular jurisdictions in the world to incorporate.The incorporation process is fast and can be achieved in 3 days and the identity of the shareholders is not publicly available.

Panama does not impose any reporting requirements for a non-resident Panamanian corporation also does not allow “piercing the corporate veil”. Panamanian corporations share certificates can be issued in Nominative or Bearer form (anonymous form of ownership), with or without par value.Nominee and bearer shares are allowed and there are no currency restrictions although the US dollar is regularly used.

Panamanian Companies can have directors, officers and shareholders of any nationality and resident of any country.The offshore entity in Panama need not appoint natural persons as directors or have individuals as shareholders. Neither the directors nor the officers of Panamanian corporations need to be shareholders. Meetings of directors, officers, and shareholders may be held in any country and accounting books may be kept in any country.

It is not necessary for the interested parties to be present in Panama for the purpose of establishing a corporation. Corporations conducting business outside of Panama do not require a commercial license for offshore business activities.

Registered Panamanian Agents offers its own executives to serve as shareholders or directors. Sometimes an intermediary law firm or a bank acts as a director or a nominee shareholder. So the real beneficiary remains hidden.The registered agent provides an official overseas address, a mail box, etc., none of which traces back the entity to the beneficial owner.

Panama’s circulating currency is the US Dollar, and it has no currency exchange controls or currency restrictions, so funds can flow in and out of the country freely.Ithas no restrictions on monetary remittances abroad, including dividends, interests, branch profits and royalties. No restrictions on funds flowing in or out of the country.

The two big draws that offshore entities in jurisdictions such as Panama offer are:

- secrecy of information relating to the ultimate beneficiary owner and

- zero tax on income generated.

In fact, in Panama individuals can ask for bearer shares, where the owner’s name is not mentioned anywhere. Besides, it costs little or nothing to set-up an entity abroad.

Panama is one of the most secure offshore financial centres – where privacy and confidentiality is vigorously protected by constitutional law and it offers the best bank secrecy and corporate book secrecy laws in the world as revealing banking information to third party is a punishable crime andhas no provision for “piercing the corporate veil”. It has no mutual legal assistance treaties (MLAT’s) for sharing of banking information with any other nation and does not recognize court rulings from other countries.Panama City is home to the second largest international banking centre in the world next to Switzerland. Panama has the most modern and successful international banking centre in Latin America, with more than 150 banks from 35 different countries.

SHELL COMPANIES, BANK ACCOUNTS AND TAX HAVENS

A shell company is a bogus entity that allows you to hold and move cash under a corporate name without international law enforcement or tax authorities knowing it’s yours.Once the money is disguised as the assets of this enterprise—which would typically be set up by a trusted lawyer or crony in an offshore secrecy haven to further obscure ownership—you can spend it or use it for new nefarious purposes. This is the very definition of money laundering—taking dirty money and making it clean—and shell companies make it possible.Generally, they are used to hide the real identity behind creators or buyers of assets. These are not established to pursue a legitimate business but to obscure the identity of beneficial owners.

Same is the case of off shore bank accounts as they are located outside a person’s country of resident, usually in a ‘tax haven’ because of financial and legal advantages.Companies or trusts can be set-up in offshore locations for legitimate uses such as business finance, amalgamation or merger and tax planning.However, these accounts are being used to avoid tax. The secrecy they provide make them attractive to corporates and high-income earning individuals who wish to conceal the sources of their funds or to evade payment of taxes.

SECRET REVEALED

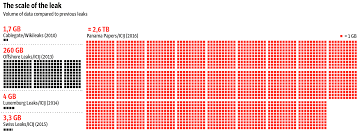

Massive 11.5 Million Confidential Documents in around 2,600 GB, leaked from the internal database of one of the biggest law firms of Panama – ‘MOSSACK FONSECA‘ by one of its employee.

These documents were obtained by SueddeutscheZeitung, a daily newspaper headquartered in Munich, Germany. Sueddeutsche shared the Panama Papers with the Washington-based non profit organization International Consortium of Investigative Journalists (ICIJ) and other news outlets, BBC, the Guardian and the Indian Express are among 107 media organisations in 76 countries which have been analysing the documents.

It is the biggest leak in history, dwarfing the data released by the Wikileaks organisationin 2010.

The documents reveal offshore accounts of 140 politicians from around the world, including 12 current and former world leaders,More than 60 relatives and associates of heads of state and other politicians, 29 billionaires onFortune’s list of the world’s 500 richest individuals, a famed soccer star, and movie stars. The data, leaked from the law firm Mossack Fonseca, includes e-mails, corporate records, passwords, and identities behind shielded bank accounts.

In all, the details of 214,000 entities, including companies, trusts and foundations, which connected to the people from more than 200 countrieswere leaked.The information in the documents dates back to 1977, and goes up to December last year. Emails make up the largest type of document leaked, but images of contracts and passports were also released.

The Panama Papers provide information about thousands of offshore entities, identities of their shareholders and directors.

INTERNATIONAL CONNECTION

Few Major Names are:-

- Russian President Vladimir Putin though his name doesn’t appear in any record but data reveals a pattern – his friend and family earns a lot.

- Icelandic Prime Minister SigmundurGunnlaugsson. He is the first victim of this massive leak as he has resigned from his position after this controversy.

- China’s top leader, Xi Jinping – members of Xi and other top Chinese officials families are tied to multiple offshore companies.

- Argentine President Mauricio Macri.

- Ukraine’s President Petro Poroshenko.

- Football star Lionel Messi and few top rank FIFA officials are also exposed in this data dump.

- Pakistan Prime Minister Nawaz Sharifthough his name doesn’t appear in any record but data reveals offshore holdings of his children’s.

- The families and associates ofMuammar Gaddafi; Bashar al-Assad; Hosni Mubarakand many others

INDIAN CONNECTION

As far as India is concerned, report claimed that over 500 Indians which includes film stars Amitabh Bachchanand AishwaryaRaiBachchan to corporates including DLF, Apollo Tyres and Indiabulls to GautamAdani’s elder brother VinodAdani. Two politicians who figure on the list are ShishirBajoria from West Bengal and AnuragKejriwal, Mumbai Ganglord Late IqbalMirchi have used the services of law firm “MOSSACK FONSECA” to set up off shore entities across the world.

INDIAN LAW

As per RBI norms, no Indian citizen could float an overseas entity before 2003 — in 2004, for the first time individuals were allowed to remit funds of up to $25,000 a year, which stands at $2,50,000 a year now under the Liberalised Remittance Scheme, this scheme has never allowed individuals to set up companies abroad, they are only allowed to buy shares.

It was only in August 2013 that individuals were allowed to set up subsidiaries or invest in joint ventures under the Overseas Direct Investment window.In most of the cases in The Panama Papers, companies were set up long before the rules were changed i.e. offshore entities are floated at a time when foreign exchanges laws of India did not allow them to do so.

Few days back Indian government has announced strict penalties and a jail term for anyone found to have undisclosed and undeclared foreign assets and accounts, they have given an opportunity to every Indian for declaration of offshore assets and accounts in form of 90 days long “Compliance Scheme” which ended on 30th September 2015.

If information leaked in the Panama Papers provides evidence that Indian residents did not declare their foreign income or foreign assets in their return of income or under Voluntary Disclosure Scheme, they shall be taxed at a flat rate of 30%. The penalty for such suppression of income or asset shall be equal to 3 times of the amount of tax payable thereon. Further, there shall be rigorous imprisonment from 3 years to 10 years for such tax evasion

MOSSACK FONSECA

Mossack Fonseca & Co. is a law firm and corporate service provider based in Panama with more than 40 offices worldwide.It specializes in commercial law, trust services, investor advisory and international structures.It provides services like incorporating companies in offshore jurisdictions, wealth management, private banking, accounting services, etc.

This law firm is one of the seven firms that collectively represent more than half of the companies incorporated in Panama.It also provides assistance in transferring funds, buying property, setting-up trusts or signing agreements with entities.Mossack Fonseca plays a crucial role in incorporating entities in tax havens.

It had incorporated 14,658 active companies in Panama till August, 2013 out of which 4,646 companies were incorporated without providing any information about their shareholders.

AUTHENTICITY

Ramon Fonseca co-founder of the law firm, Mossack Fonseca, hasconfirmed the authenticity of the papers being used in articles published by more than 100 news organisations around the world. He told Panama’s Channel 2 television network that the documents are real and were obtained illegally in a hacking attack.

Generally, it would be tough to establish the authenticity of the leaked documents, as they may not be admissible in the court of law. But this whole process could see reputation risk and harassment of these high net worth Individuals.

At last I can conclude that this massive leak has revealed the global elite’s secret cash haven and fallout has just begun for some of the world’s most prominent faces.

(The writer is Chartered Accountant and founder member of think tank POLICY SAMVAD, who may be contacted at khan.uves@gmail.com, Web: – www.khangargassociates.com)

Times Of Pedia Times of Pedia TOP News | Breaking news | Hot News | | Latest News | Current Affairs

Times Of Pedia Times of Pedia TOP News | Breaking news | Hot News | | Latest News | Current Affairs